7 Easy Facts About Vancouver Tax Accounting Company Shown

That occurs for every single purchase you make throughout an offered accounting period. Working with an accountant can help you hash out those information to make the audit procedure job for you.

You make changes to the journal access to make certain all the numbers add up. That may include making improvements to numbers or dealing with accumulated items, which are expenses or income that you sustain yet do not yet pay for.

For aiming money experts, the concern of bookkeeper vs. accountant is common. Accountants and also accountants take the very same fundamental bookkeeping courses. Accountants go on for more training and education and learning, which results in differences in their roles, earnings assumptions as well as occupation growth. This overview will certainly offer an in-depth break down of what divides bookkeepers from accounting professionals, so you can understand which accounting function is the most effective fit for your job goals now and in the future.

The Single Strategy To Use For Cfo Company Vancouver

An accountant improves the information provided to them by the bookkeeper. Typically, they'll: Evaluation economic declarations prepared by an accountant. Assess, interpret or vouch for this info. Turn the info (or documents) right into a report. Share recommendations and make suggestions based upon what they've reported. The records reported by the accountant will certainly establish the accounting professional's recommendations to management, and also ultimately, the health and wellness of the business in general.

e., federal government firms, universities, healthcare facilities, and so on). A knowledgeable and proficient accountant with years of experience and first-hand understanding of accountancy applications ismost likelymore qualified to run guides for your service than a recent accounting significant graduate. Maintain this in mind when filtering applications; attempt not to evaluate applicants based upon their education alone.

Future projections as well as budgeting can make or break your business. Your financial records will certainly play a significant role when it concerns this. Organization forecasts as well as trends are based on you can try this out your historic economic information. They are needed to assist ensure your company stays successful. The economic information is most trusted as well as accurate when given with a durable as well as organized accountancy procedure.

The Ultimate Guide To Vancouver Accounting Firm

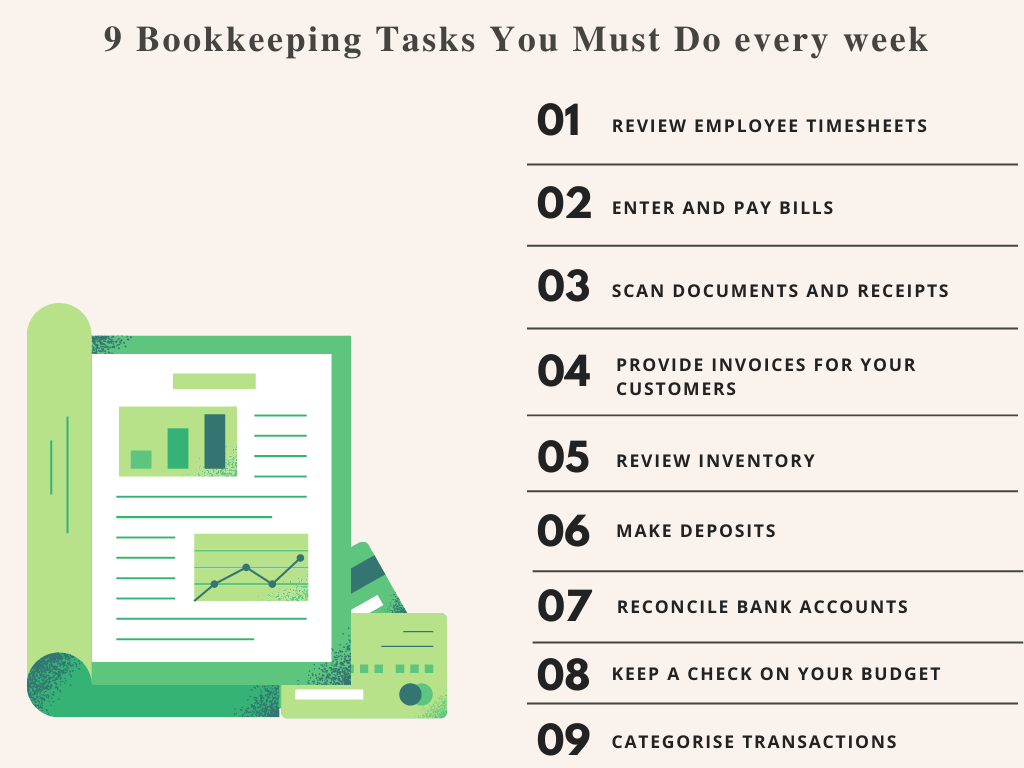

Accounting, in the typical feeling, has actually been about as long as there has been business considering that around 2600 B.C. An accountant's task is to preserve complete records of all money that has entered and also headed out of business - outsourced CFO services. Bookkeepers record day-to-day purchases in a consistent, easy-to-read method. Their records enable accounting professionals to do their tasks.

Generally, an accounting professional or proprietor manages an accountant's work. An accountant is not an accountant, nor ought to they be thought about an accountant. Bookkeepers record monetary transactions, post debits as well as credit reports, develop billings, take care of pay-roll as well as maintain as well as stabilize the publications. Bookkeepers aren't needed to be licensed to deal with guides for their clients or company yet licensing is available.

3 main aspects affect your prices: the services you desire, the know-how you require and your regional market. The accounting services your company demands and the amount of time it takes once a week or month-to-month to complete them influence how much it costs to employ an accountant. If you require someone to come to the office when a month to reconcile guides, it will set you back less than if you require to work with a person full-time to handle your everyday operations.

Based on that computation, determine if you require to hire someone full time, part-time or on a job basis. If you have complicated publications or are generating a great deal of sales, hire a licensed or accredited accountant. A seasoned bookkeeper can offer you tranquility of mind and also confidence that your finances remain in excellent hands yet they will certainly also cost you more.

5 Simple Techniques For Tax Consultant Vancouver

If you live in a high-wage state like New York, you'll pay even more for a bookkeeper than you would in South Dakota. There are a number of benefits to working with a bookkeeper to submit and document your service's economic records.

They might pursue added additional hints qualifications, such as the CPA. Accounting professionals may likewise hold the setting of bookkeeper. If your accountant does your accounting, you might be paying even more than you must for this solution as you would normally pay more per hr for an accounting professional than an accountant.

To complete the program, accounting professionals have to have 4 years of pertinent work experience. The point right here is that hiring a CFA suggests bringing extremely advanced audit understanding to your service.

To obtain this accreditation, an accountant should pass the needed tests and have two years of specialist experience. You might employ a CIA if you desire a much more customized emphasis on economic threat assessment and you could try this out protection surveillance processes.